how to pay indiana state tax warrant

If you are disputing the amount owed call the Department of Revenue at 317-232-2240. If you cant pay your tax debt in full you may be able to set up an installment payment agreement IPA to prevent additional collection action.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Claim a gambling loss on my Indiana return.

. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Find Indiana tax forms. And 3 Disclaim any.

State of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. By utilizing this Tax Warrant Collection System and the Service You represent and warrant that Your use will be lawful. The Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue.

Claim a gambling loss on my Indiana return. Click here to view more events. Know when I will receive my tax refund.

Pay my tax bill in installments. A payment submitted by You through this Tax Warrant Collection System implies Your compliance with the law. Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following.

What is a tax warrant. As part of the Tax Amnesty 2015 program eligible taxpayers are allowed to submit a request to have tax warrants expunged from their records. Illinois Street Suite 700.

1 Do not warrant that the information is accurate or complete. We file a tax warrant with the appropriate New York State county clerks office and the New York State Department of State and it becomes a public record. Office of Trial Court Technology.

Your Indiana tax debt might be being collected by 1 or more of the 3 agencies listed below. These taxes may be for individual income sales tax withholding or corporation liability. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to.

Property that constitutes evidence of an. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC. For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am.

You might be interested. 2 Make no representations regarding the identity of any persons whose names appear in the information. The Indiana Department of Revenue first files a lien at the County Clerks Office then forwards a copy to this office.

Find Indiana tax forms. The direct payments from the states surplus were the. The terms of your payment plan depend on who is collecting your Indiana tax debt.

Take the renters deduction. Failure to file a tax return. How do I pay a tax warrant in Indiana.

Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue. If the State does not receive notification that a payment plan has been. You will need to have your taxpayer identification number or Social Security number and Letter ID.

A monthly payment plan must be set up. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. There are three stages of collection of back Indiana taxes.

Property that is illegal to possess. This penalty is also imposed on payments which are required to be remitted electronically but are not. Have more time to file my taxes and I think I will owe the.

If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant. All Indiana taxpayers would be eligible for a 200 automatic taxpayer refund under legislation moving its way through the Statehouse. Tax Warrants in the State of Indiana may be issued by the.

Take the renters deduction. However circuit clerks using the INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax. The agency who is collecting your Indiana tax debt depends on how long you have owed your Indiana tax debt.

Know when I will receive my tax refund. Doxpop provides access to over current and historical tax warrants in Indiana counties. E-Tax Warrant Search Services.

Payment by credit card. Find Indiana tax forms. Our service is available 24 hours a day 7 days a week from any location.

Have more time to file my taxes and I think I will owe the Department. Indiana State Tax Warrant Information. Although this is not a warrant for your arrest the information will appear on a credit report or title search and becomes a lien on your property.

Property is possessed by a person who wishes to use it to commit a crime or hide it to prevent the discovery of a crime. A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt. Preparation by Department 20 penalty.

This Tax Warrant Collection System is designed to help You to make payments to a sheriffs department for tax warrants. Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Questions regarding your account may be forwarded to DOR at 317 232-2240. Have more time to file my taxes and I think I will owe the Department. Do not call the Hamilton County Sheriffs Office as this agency has nothing to do with setting the amount of taxes owed.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Completed Expungement Request Forms and supporting documentation may be returned to taxadvocatedoringov or via mail to. About Doxpop Tax Warrants.

Indiana Department of Revenue. User Agreement for e-Tax Warrant Search Services. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code.

Know when I will receive my tax refund. Pay my tax bill in installments.

Dor Requesting An Extension Of Time To File Via Intime

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Dor Requesting An Extension Of Time To File Via Intime

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Dor Requesting An Extension Of Time To File Via Intime

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

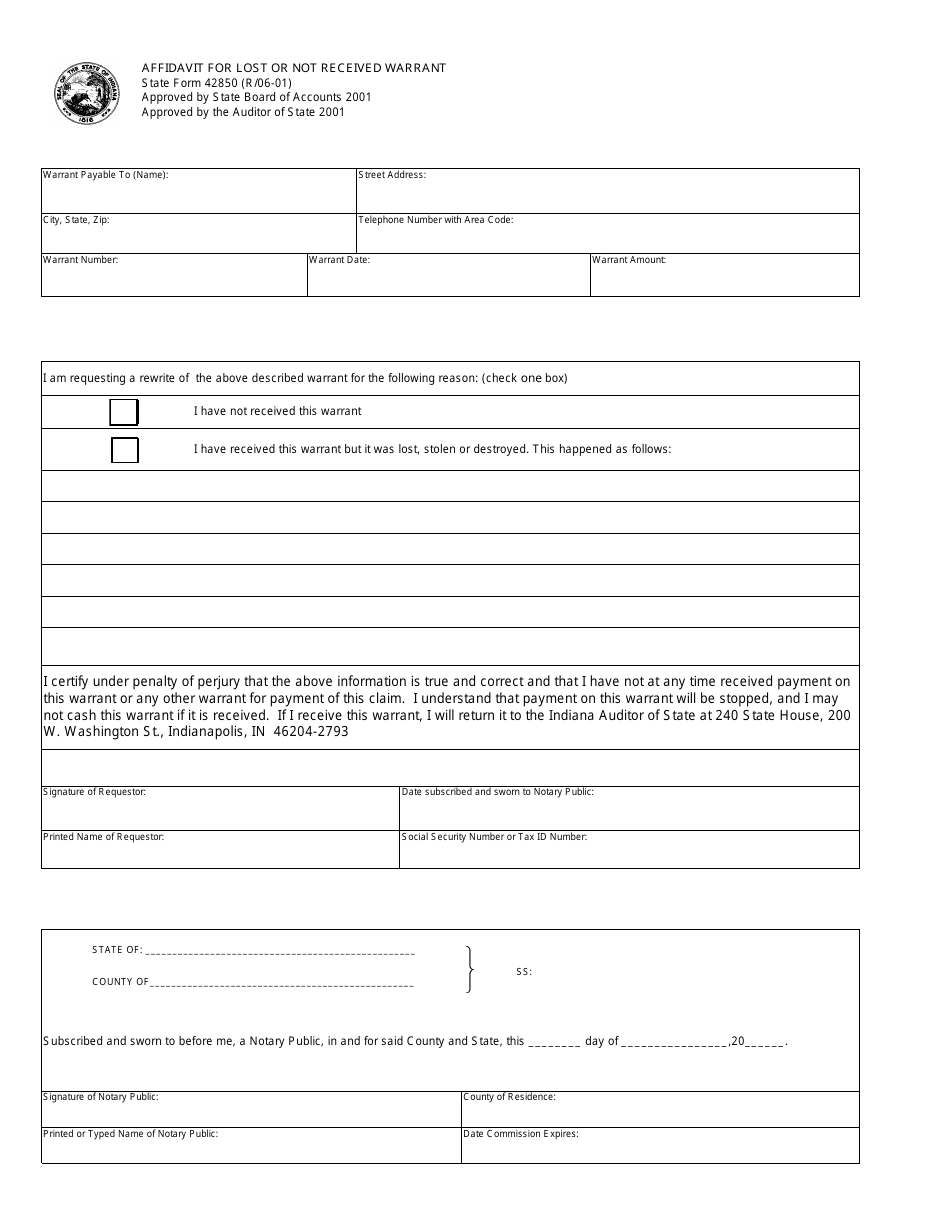

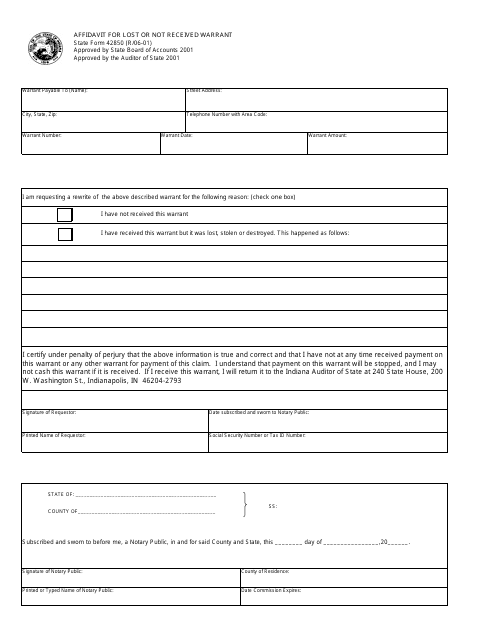

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Sample Letter To Judge To Remove Warrant Fill Online Printable Fillable Blank Pdffiller

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Can Indiana Issue A Warrant For Unpaid Taxes Levy Associates