stock option exercise tax calculator

Your taxes will be paid on 10 minus 5 equaling 5. For 2020 the threshold where the 26 percent AMT tax.

How Are Incentive Stock Options Taxed Legalzoom

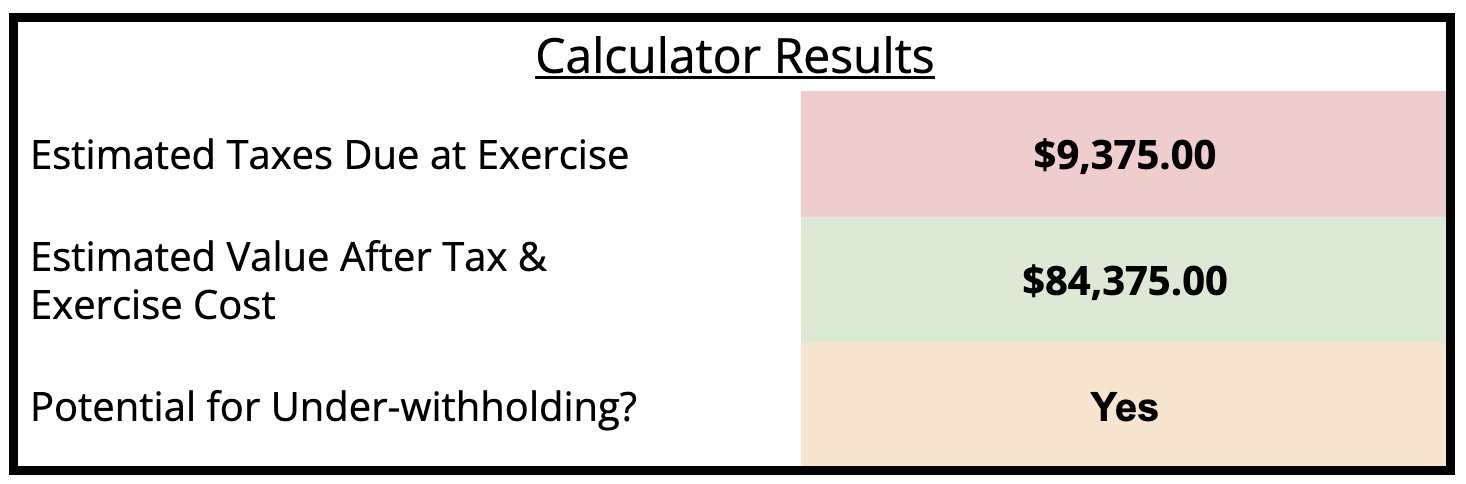

Use the Stock Option Tax Calculator to calculate your estimated tax bill.

. You will only need to pay the greater of. Please enter your option information below to see your potential savings. Say in total you have 15000 ISOs.

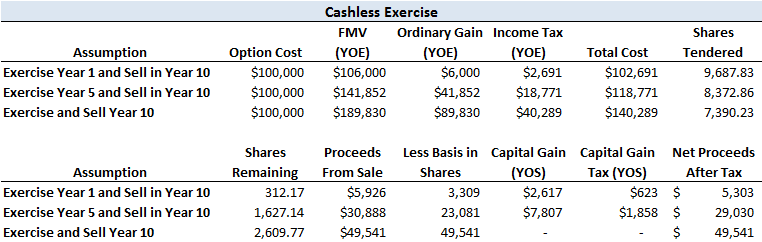

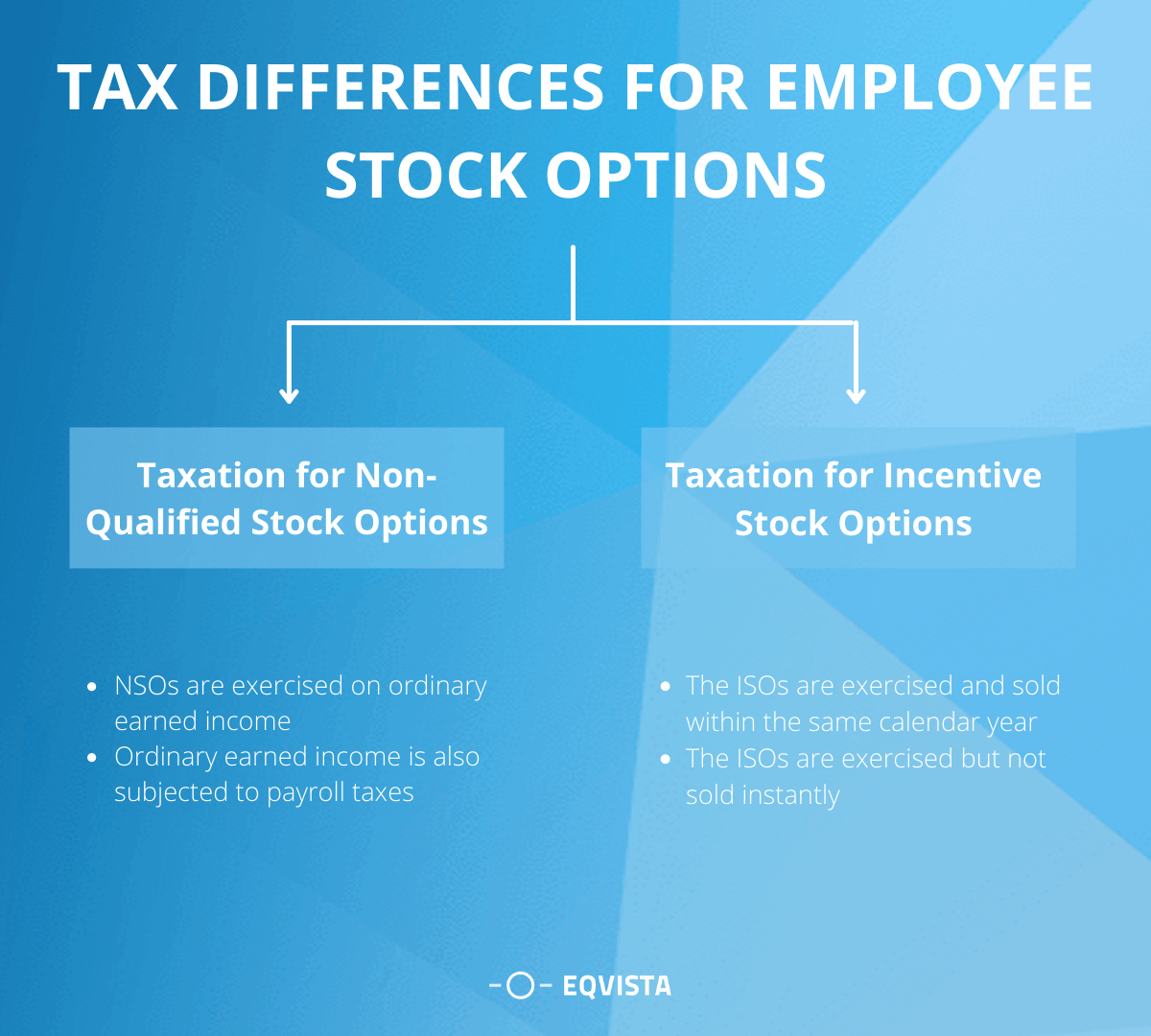

The most common form of NSO exercise is a Sell to Cover which means youre selling shares immediately after an NSO exercise to cover the cost of the exercise as well as. Taxes for Non-Qualified Stock Options. When cashing in your stock options how much tax is to be withheld and what is my actual take-home amount.

You can find your federal tax rate here. Stock Option Tax Calculator. When you exercise youll pay.

Exercise incentive stock options without paying the alternative minimum tax. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. There are two types of taxes you need to keep in mind when exercising options.

Exercise incentive stock options without paying the alternative minimum tax. We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base. Stock Option Tax Calculator.

The options were granted within 10 years of the adoption of the Stock Option Plan and within 10 years of approval by the stockholders of the grantor. Calculate the costs to exercise your stock options - including. Net Value After Taxes.

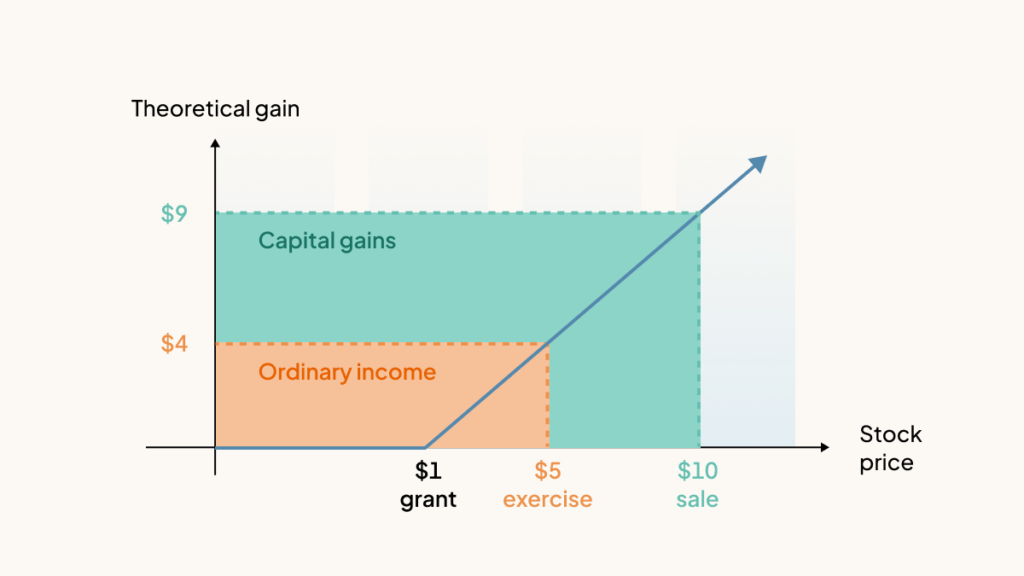

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Exercise incentive stock options without paying the alternative minimum tax. In our continuing example your theoretical gain is.

Say you have 1000 options at a strike price of 250 and the current 409A valuation is 10. This calculator illustrates the tax benefits of exercising your stock options before IPO. Lets say you got a grant price of 20 per share but when you exercise your.

Incentive stock option iso calculator. Calculate the costs to exercise your stock options - including. The results provided are an.

Cash secured put calculator addedcsp calculator. The rest of the numbers are the same as before. The strike price of 2500 1000 250 Taxes on.

On this page is an Incentive Stock Options or ISO calculator. Incentive stock option iso calculator. Cash secured put calculator addedcsp calculator.

The terms of the Option Grant specify. Calculate the costs to exercise your stock options - including. Looking to Unlock the Value.

Its free Compare the final tax bill with the amount of withholding that your company provides. When your employee stock options become in-the-money where the current price is greater than the strike price you can choose from one of three basic sell strategies. Exercise incentive stock options without paying the alternative minimum tax.

Simple example Option exercise calculator to employees will begin to. Stock Option Tax Calculator. Calculate the costs to exercise your stock options - including.

On this page is a non-qualified stock option or NSO calculator. Heres a real-life example. Stock Option Tax Calculator.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Exercising your non-qualified stock options triggers a tax. Our Stock Option Tax Calculator automatically accounts for it.

The jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. Your taxes will be paid on 10 minus 5 equaling 5. Ordinary income tax and capital gains tax.

8 Tips If You Re Being Compensated With Incentive Stock Options Isos

Secfi Stock Option Tax Calculator

How Much Are My Options Worth Eso Fund

What Are The Holding Period Requirements Of An Iso Mystockoptions Com

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Net Exercising Your Stock Options

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Non Qualified Stock Options Definition Examples Why Are They Used

Understanding Employer Granted Stock Options Eagle Claw Capital Management

Employee Stock Options And 409a Valuations Eqvista

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Incentive Stock Options Turbotax Tax Tips Videos

The Mystockoptions Blog Stock Options

How Are Stock Options Taxed Carta

You Can T Afford To Make Poor Decisions About Incentive Stock Options Techcrunch